The CDMO landscape is evolving rapidly, with certain segments — such as biologics, cell and gene therapies and advanced aseptic manufacturing — experiencing strong growth, while more traditional small-molecule and generics-focused areas face increasing margin pressure and consolidation. In this environment, a clear strategic positioning and forward-looking equity story are indispensable to present an attractive M&A opportunity and to capture investor interest.

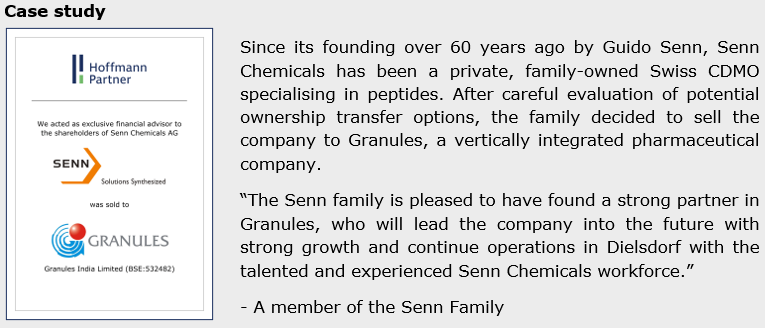

Hoffmann & Partner is an expert in advising mid-sized life science companies, in particular CDMOs, CROs and suppliers, on identifying suitable successors, preparing for investor discussions and managing international transactions with discretion, expertise and deep sector insight.

This newsletter is intended for owners, investors and founders of CDMO companies who are interested in exploring strategic options or partnering opportunities via external M&A.

Robust growth in the CDMO market

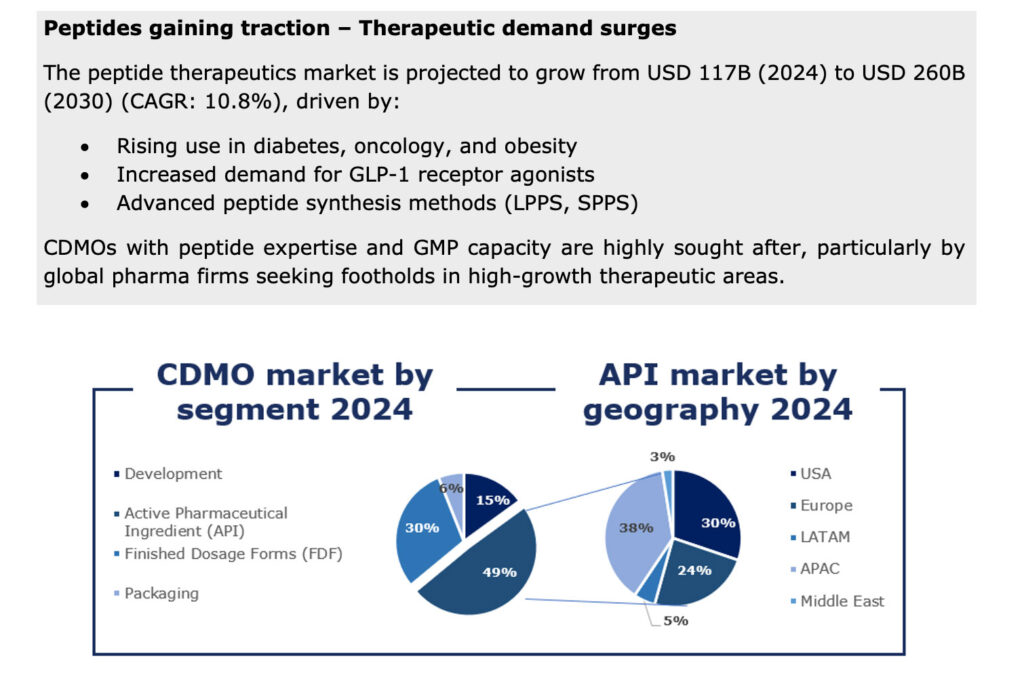

The CDMO market is projected to grow at a CAGR of around 7.3% from 2025 to 2032, driven by the rising prevalence of chronic and infectious diseases, growing demand for personalised medicine, wider adoption of point-of-care testing, a growing geriatric population, supportive government initiatives, expansion in emerging markets — particularly in Asia-Pacific — and ongoing technological advancements.

Notably, biologics now represent over 40% of the pharma R&D pipeline, underlining their role in shaping future CDMO capacity and specialisation.

What buyers are looking for

- Investors and strategic buyers in the CDMO sector are focusing on several key factors that significantly influence the attractiveness and valuation of a business:

- Expertise in biologics and peptides is highly valued, as it provides access to fast-growing therapeutic areas such as oncology, metabolic disorders, and personalised medicine.

- A well-established GMP infrastructure serves as a reliable platform for both clinical trial production and commercial-scale manufacturing, ensuring scalability and compliance.

- A solid regulatory track record in highly regulated markets like the EU and the US strengthens buyer confidence and reduce integration risk.

- Proven innovation in process technologies, such as continuous manufacturing or automated quality control systems, enhances efficiency and positions the CDMO as a technology-driven partner.

- A succession-ready management team and second-level leadership are considered essential for ensuring operational continuity after the transaction and reducing buyer dependency on the founder.

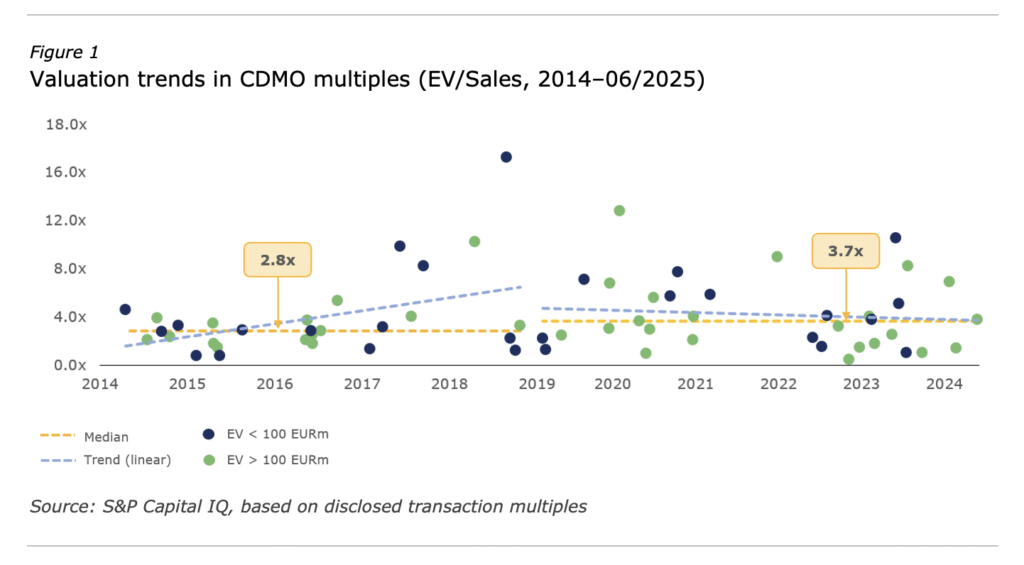

M&A momentum continues, valuation stagnates

Despite a moderate post-COVID correction in valuation multiples, M&A appetite in the CDMO sector remains high:

• EV/Sales multiples are still +0.9x above pre-2020 levels (see Figure 1)

• Investors seek end-to-end capabilities, specialisation & scalability

• High interest from PE investors and global pharma acquirers

• Europe & North America benefit from regulatory alignment and reshoring trends

Nevertheless, it can be observed that valuations have stagnated and have hardly developed post-COVID, which could indicate that it would be a good time to sell before valuations are corrected downwards.

Final takeaway

The CDMO landscape is evolving rapidly, shaped by technological breakthroughs, consolidation, and strong global demand. Hoffmann & Partner offers deep expertise and tailored M&A execution for CDMO founders, investors, and acquirers navigating this dynamic environment. Whether you are exploring a partial sale, full exit, or simply testing strategic interest, the right preparation can significantly enhance valuation, transaction certainty, and partner alignment.

Contact us

Contact us for more information or for a valuation report that provides valuable insights into current valuation levels, market trends and strategic interests in this sector.

Your Hoffmann & Partner team

info@hoffmann-partner.com

About Hoffmann & Partner

We have been bringing entrepreneurs and successors together since 2011 — from traditional family businesses to specialised companies from various industries. As experienced M&A advisors, we support entrepreneurs in all phases of the sales process — from the initial assessment to successful completion. We open up access to strategic buyers or suitable financial investors. Thanks to our membership of the international M&A organisation AICA, we can also approach international interested parties in a targeted manner and accompany transactions across borders. Hoffmann & Partner also has a broad network of potential successors – from strategic buyers and financial investors to experienced managers and motivated young entrepreneurs. We bring entrepreneurs together with suitable successors or buyers from our network in a structured, discreet and targeted manner.